自动化供应商和分析师touting for years that asset management and maintenance processes, aided by software, can significantly improve production and save bottom-line dollars. Asset management is also often the first test of Industrial Internet of Things (IIoT) technologies, since it benefits greatly from the analysis of data acquired by sensors on operating assets. New research fromAutomation Worldreveals what maintenance strategies are being implemented and why.

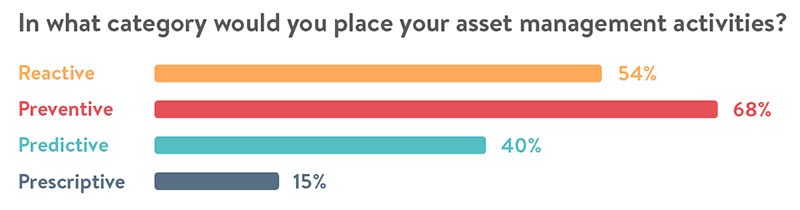

In a recent survey of our readers, more than half of respondents (59 percent) say they have a formal asset maintenance strategy in place or they plan to implement one in the near future. That means they use one of four generally accepted approaches:

- Reactive maintenance strategies, in which slowdowns and failures are addressed as they arise.

- Preventive maintenance, in which equipment maintenance is performed on a pre-planned schedule in an effort to replace or maintain parts before they fail.

- Predictive maintenance, in which equipment operation is monitored using sensors and historical data is analyzed in an attempt to predict pending failure and address it proactively.

- Prescriptive maintenance, in which equipment operation is continuously monitored using sensors, then real-time and historical data is analyzed by advanced software to prescribe specific maintenance activities that ensure optimal equipment uptime.

A fifth category of asset management, run to failure, assumes that equipment will run until it breaks and then a determination will be made if it should be repaired or replaced. This is a legitimate strategy for handling certain types of assets but is not considered a proactive approach like preventive, predictive or prescriptive maintenance.

|

Large and midsize process organizations with sophisticated equipment in asset-intensive industries tend to consider and use all types of proactive maintenance strategies. “There are very few large industrial operations without some form of proactive maintenance program,” says David M. Buttner, director of operational certainty consulting for Emerson Automation Solutions. “However, legacy planned maintenance programs—which rely heavily on manual inspections—are still very pervasive. Among top-quartile performers, it’s the opposite. Predictive maintenance processes are the norm, and [those plants] are seeing significant improvements in equipment availability and savings in bottom-line dollars.”

Smaller organizations often focus on trying to improve their preventive maintenance performance, says Ed O’Brien, director of research for ARC Advisory Group. “Because of limited resources and high equipment utilization rates, they seem to encounter more unplanned, corrective maintenance,” he says. “The strategy then defaults to run to failure, even though that’s not their plan. Most all aspire to be more preventive, and then more predictive.”

It’s still nascent for some organizations to be truly prescriptive, O’Brien says. “You may use predictive analytics, and have a sense of what to do, but truly looking into a crystal ball and doing prescriptive maintenance? I think that is what every organization is striving to do and do better.”

Survey results bear this out. More than half of survey respondents report using one or more proactive asset maintenance strategies. About 68 percent say they have preventive strategies in place, while 40 percent are using some sort of predictive strategy. Prescriptive maintenance strategies are used by just 15 percent of respondents.

|

Data and analytics are key

Being more preventive, predictive or prescriptive “depends on being able to have a true analytic strategy,” O’Brien says. “In some organizations, this may not have fully trickled down to the maintenance departments. They may have great reporting, but not good analytics. Analytics is just now taking root.”

The idea of prescriptive maintenance has been around since the 1960s, according to Greg Perry, senior capacity assurance consultant for Fluke Digital Systems. “The term was coined by equipment reliability legend Jack R. Nicholas Jr. and had to do with job scheduling. It included detailed instruction sets to eliminate and mitigate failures. With IIoT, you now have RxM, prescriptive maintenance, that is data-driven.”

与规范的维护,“你想使用the empirical data, plus the history of the asset, and you want to prescribe what you need to do,” Perry says. “That is moving us into connected reliability. You are using analytics to make the maintenance action more automatic.”

|

Fluke’s Accelix reliability platform is a cloud-based CMMS that presents infrared, vibration, power, temperature and electrical data mapped to asset inventory and trended over time to manage asset health and maintenance. Source: Fluke |

Having a good data analytics, data cleansing and data management strategy is critical no matter what proactive strategy you choose, O’Brien notes. “Data is what makes a good predictive maintenance function hum,” he says. “To do prescriptive maintenance, you have to have some form of analytics as well. There needs to be a collection of strong trend data that can be converted into actionable information. Getting the clouds out of the crystal ball will happen because of better quality data.”

Elinor Price, product marketing leader for Honeywell Connected Plant, agrees. “You have the ability with Big Data to be able to take all the data from the process and merge it with the data from the assets,” she says. “That is bridging two worlds. That is a challenge, but there’s a huge amount of insight you can gain.” Not mining your asset data with your process data misses the big-picture costs.

“If you lost a compressor, for example, and you’re down for X days, how much does that cost you?” Price asks. “What is preventing that worth to you? But the compressor hasn’t gone down for five years, so how do you know? You need analytics to tell you.”

Data cleansing and data management processes throughout the organization—not just in operations and maintenance—will improve, experts say. “All of that means that prescriptive maintenance efforts will be more successful and the success stories much more rich as we go forward in the next two to three years,” O’Brien says. “They’re on the beginning of the journey, and converting this data into information may take some time.”

Emerson’s Buttner adds, “There have been major advances in predictive maintenance adoption, and we expect that to continue in the next 10 years as many reactive maintenance organizations make it a significant component of digital transformation initiatives.”

|

Investment enables asset management

Before companies can get to the analytics, they have to make sure they have the data—especially the right data about the right assets. Perry suggests performing a criticality analysis on legacy systems. “Get your master data straight, then decide what’s critical,” he says. “You might find out that you thought [an asset] was critical only because it was a bad actor. Know what actions you are applying to a bad-actor asset.”

You might also find out that you were wasting your time with the preventive maintenance tasks you were doing. “You’re not going to do predictive maintenance on everything,” Perry says. “Too often, clients go right to the technology, but you’re never going to software yourself to reliability.”

请记住,资产管理策略more than technologies, Buttner adds. “You must go further so that you have coordination between people, processes and technology,” he says. “All of this converges to ensure that information is acted upon effectively to avoid critical equipment failure. A lack of effective work management practices is often the main obstacle to generating benefits from asset management strategies.”

Companies are making investments to support proactive maintenance strategies, according to the survey. Almost 40 percent view asset management as part of a company-wide IIoT initiative, rather than just an operations or maintenance activity. The majority report having three types of technology currently in place: sensors for acquiring equipment operation data (55 percent), software for aggregating and analyzing data (55 percent), and a computerized maintenance management system (CMMS) or other maintenance scheduling software to automate acting on the results (63 percent).

Though 41 percent said they don’t plan to make any additional technology purchases to optimize their maintenance strategies, about 20 percent planned to add sensors and 20 percent planned to add data aggregation or data analysis software. Fewer (about 16 percent) planned to add a new CMMS and/or a full enterprise asset management (EAM) software suite.

Two factors are driving the relatively high interest in asset data collection and analysis, Buttner says. “One, to enable analytics, you need sensing data and history. Two, wireless sensing deployment is a low-cost investment; as you compile asset condition data, you need tools to turn it into useful information,” he says, adding that the lower interest in CMMS/EAM investments “likely results from the fact that most industrial operations made large investments in this area during the last decade.”

|

Honeywell’s Connected Plant Asset Performance Insight software enables predictive analytics for optimizing maintenance and operations by integrating asset and process data. Source: Honeywell |

Returns on investment

Because the benefits of proactive maintenance strategies are clear, users can calculate ROIs. “For predictive maintenance programs, we see conservative returns of double-digit growth in maintenance productivity, incident-free safety operations, and several point gains in operational availability,” Buttner says. “All of these deliver long-term payback for organizations.”

Since investment in point-solution sensing technologies such as vibration monitoring is typically low, a one-year payback is a reasonable rule of thumb and “a faster-than-one-year payback is readily attainable assuming timely corrective action is taken on a valid alarm,” Buttner says.

“It’s important that in any decisions organizations make, they evaluate the ROI at each stage as they scale up their asset management software and strategies,” he adds. “For example, point-solution sensing technologies can be low-cost, but integration across platforms can increase the investment needed.”

When asked if they had achieved the ROI they hoped for from their asset management strategy, 52 percent of survey respondents said ROI met or exceeded expectations. Another 41 percent said that they hadn’t yet but expect to reach ROI within the expected timeframe.

Proactive maintenance strategies have another compelling reason for consideration: There is a shortage of skilled maintenance technicians and this problem is only going to get worse. This trend leaves manufacturers with no option but to become more proactive and technology-driven with their asset management strategies.

Does Outsourcing Asset Management Make Sense?

WhenAutomation Worldsurveyed its readers about asset management and equipment maintenance strategies, questions about outsourcing revealed that 44 percent of respondents outsourced some or all of their asset management responsibilities to equipment OEMs. Reasons cited include:

- It’s part of the OEM’s service-level agreement with us (58 percent).

- A skills shortage requires us to depend on the machine builder (53 percent).

- Remote access and cloud technologies make it easier to offload asset management service from the OEM (33 percent).

If they don’t outsource asset management responsibilities, half (50 percent) say it’s because corporate policy insists asset management control must remain in-house. Other reasons to not outsource include wanting to manage production lines rather than individual machines (22 percent); IT does not allow external vendors access to the plant floor for security reasons (13 percent); and their OEMs don’t offer such a service (7 percent).

There’s likely to be more use of outsourced resources for equipment maintenance, according to Ed O’Brien, director of research for ARC Advisory Group. “Especially in high-asset-intensive industries—robotics, autonomous warehouse equipment, etc.—downtime is such a killer,” he says. “There’s a great need to use OEMs.”

Users are willing to share data with OEMs and there has already been a lot of outsourcing of maintenance in the upstream oil and gas space, according to Elinor Price, product marketing leader for Honeywell Connected Plant. “We think in some segments we’re going to see more,” she says.

In other industries, “OEMs are starting to get into the reliability business,” says Greg Perry, senior capacity assurance consultant for Fluke Digital Systems. “For example, [packaging machine maker] TetraPak builds automation equipment that’s fully connected, and they are feeding that data back to improve their machines. They are using this data to design for reliability. You’re going to see pump and motor manufacturers getting into this. You’re going to see OEMs sensor their legacy equipment.”

And that’s when you will see the true predictive maintenance algorithms and strategies emerge, Perry says.